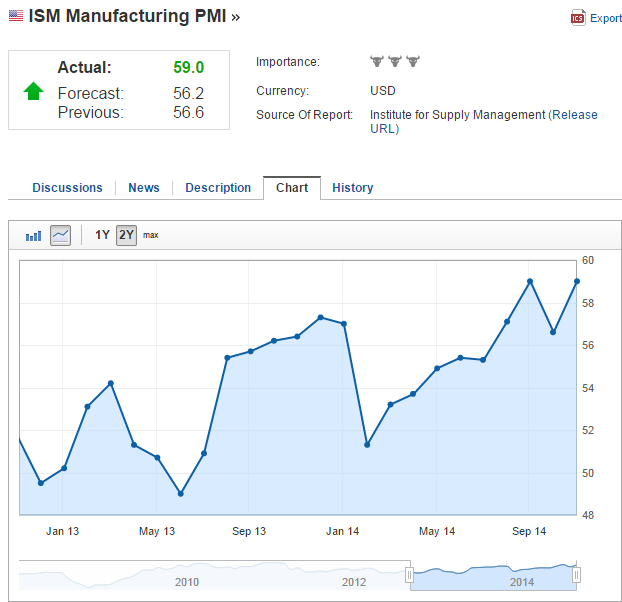

The S&P 500 rose 0.49% this week as there were mixed views of economic indicators and monetary policies. ISM Manufacturing PMI shows a positive industrial outlook that it exceeds market forecast. Investors worried that slow in China economy and slowdown in eurozone would decelerate U.S. economy as well, but it turns out that manufacturers have more optimistic view. Along with the PMI, Factory Order declined by 0.6% but this decline was lead by airplane order; it had a restricted impact on the market.

In fact, there was a controversial economic data was released on last Friday: labor market. While unemployment rate declined to 5.8% and the Participant Rate rose by 0.1%, Average Hourly Earnings and Nonfarm Payroll have declined. These indicators suggest that U.S. labor market still has a room for improvement that they wouldn't pressure the Fed. to increase the interest rate in anytime soon. Janet Yellen added on Friday that "normalization could lead to some heightened financial volatility." It means that the Fed. will conduct additional stress test or give more time for investors to adjust into new interest rate.

In fact, there was a controversial economic data was released on last Friday: labor market. While unemployment rate declined to 5.8% and the Participant Rate rose by 0.1%, Average Hourly Earnings and Nonfarm Payroll have declined. These indicators suggest that U.S. labor market still has a room for improvement that they wouldn't pressure the Fed. to increase the interest rate in anytime soon. Janet Yellen added on Friday that "normalization could lead to some heightened financial volatility." It means that the Fed. will conduct additional stress test or give more time for investors to adjust into new interest rate.As a result, the S&P 500 had a restricted movement this week.

European market had more issues than U.S. market this week, but it showed a restricted movement.

Those poor economic indicators were expected in a way. Geopolitical tensions last too long, which continuously weakened eurozone economy, especially manufacturing industry in Germany. Surprise came from U.K. Service PMI that that had a sudden decline from past month. But the facts that it still maintains high level and the housing price stabilization resulted as a restricted market movement.

After the BOJ announced additional stimulus on October 31, there were voices that the ECB should implement the quantitative easing. As a matter of fact, the European Commission statement implied additional stimulus on the market, given the consideration that eurozone growth will be only 0.8% in 2014 and 1.1% in 2015, and inflation rate will be 0.6% in 2014 and 1.0% in 2015. Mario Draghi added on the speech that he is still considering stimulus on the market. The thing is, he had kept saying that for months now. It is still "promise" rather than "action." The market will not have strong respond unless the ECB actually implements new stimulus in the market.

댓글 없음:

댓글 쓰기